等了几年都没有机会以赚钱价卖出的股票,今天看股票交易所的布告栏才发现到被宣布除牌了。从买进的RM1一个unit,变成今天的RM 0.025,亏大本了。如果买1000个unit,等于马币一千元,亏了剩下马币 25元,流汗~~。

还好不是买很多lot,不知道是幸运还是不幸运。 以下是从股票交易所网站看到的宣布消息。

Company Name |

: |

COMSA FARMS BERHAD |

Stock Name |

: |

COMSA |

Date Announced |

: |

03/04/2007 |

|

|

|

Type |

: |

Announcement |

Subject |

: |

COMSA FARMS BERHAD ("Comsa" or "the Company")

Decision in respect of the Appeal against de-listing of the securities of Comsa from the official list of Bursa Malaysia Securities Berhad ("Bursa Securities") |

Contents :

We refer to our announcement dated 26 February 2007 in respect of Bursa Securities' decision to de-list the securities of Comsa from the Official List of Bursa Securities.

Comsa had submitted an appeal against the decision of Bursa Securities to de-list its securities from the Official List of Bursa Securities. Given the appeal by the Company, the removal of the securities of the Company was deferred pending the decision on the appeal by Bursa Securities ("Appeal").

After having considered all the facts and circumstances of the matter, Bursa Securities has vide its letter dated 3 April 2007, resolved that the Appeal by the Company be disallowed and decided to de-list the Company from the Official List of Bursa Securities as the Company has failed to announce the Company's regularization plan within the extended timeframe granted by the Bursa Securities.

In arriving at the aforesaid decision, the Appeals Committee ("AC") had regarded all the issues and in particular the following factors:-

(a) The Company had failed to regularize its financial condition and level of operations within the timeframes prescribed in paragraph 8.14C of the Listing Requirements of the Bursa Securities ("LR") and paragraph 4.0 of Practice Note No. 17/2005 ("PN17") and the extended timeframe granted by the Listing Committee as stated in the letter dated 25 January 2007;

(b) Since the First Announcement on 7 April 2006, as at 30 March 2007, the Company has had approximately 11 ½ months to regularize its financial condition and level of operations;

(c) As at 30 March 2007, the Company has yet to announce and submit its proposed regularization plans to the relevant authorities for approval;

(d) All PN17 companies are required to regularize the financial condition and level of operations expeditiously within the timeframe prescribed in Paragraph 8.14C of the LR and PN17;

(e) The requirement for companies to have an adequate level of financial condition and level of operations serves to ensure the companies listed on the Official List are of a certain minimum quality. Companies that have a minimum level of financial condition and level of operations serve to preserve and sustain market integrity and investors' confidence; and

(f) In the opinion of the AC, adequate time and opportunity has been accorded to the Company to regularize the financial condition and level of operations.

Accordingly, please be informed that the securities of the Company will be removed from the Official List of Bursa Securities at 9.00 amon Friday, 13 April 2007.

With respect to the securities of the Company which is currently deposited with Bursa Malaysia Depository Sdn Bhd ("Bursa Depository"), the securities may remain deposited with Bursa Depository notwithstanding the de-listing of the securities from the Official List of Bursa Securities. It is not mandatory for the securities of the Company to be withdrawn from Bursa Depository.

Alternatively, shareholders of the Company who intend to hold their securities in the form of physical certificates, can withdraw these securities from their Central Depository System (CDS) accounts maintained with Bursa Depository at anytime after the securities of the above companies have been de-listed from the Official List of Bursa Securities by submitting an application form for withdrawal in accordance with the procedures prescribed by Bursa Depository. These shareholders can contact any Participating Organisation of Bursa Securities and/or Bursa Securities' General Line at 03-2034 7000 for further information on the withdrawal procedures.

Technorati : comsa, securities, 股票

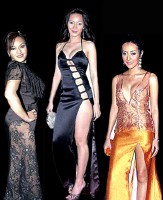

今天收到一位女性友人转寄而来的电邮,信件题目是"Aktres Thai: Chotiros Suriyawong di Majlis Anugerah Golden Swan (9/02/07) - langsung kene BAN",内有该艺人的照片。因为只有照片而已,没有说清楚到底是什么事情kene ban,好奇之下就上网搜索资料,希望更了解详情。

今天收到一位女性友人转寄而来的电邮,信件题目是"Aktres Thai: Chotiros Suriyawong di Majlis Anugerah Golden Swan (9/02/07) - langsung kene BAN",内有该艺人的照片。因为只有照片而已,没有说清楚到底是什么事情kene ban,好奇之下就上网搜索资料,希望更了解详情。 或许腰身以下的裙脚开衩不要开那么高,把屁股遮盖,感觉上会比较好。

或许腰身以下的裙脚开衩不要开那么高,把屁股遮盖,感觉上会比较好。